Fill Up Your Portfolio with Crude Oil & Stay Driven

Crude oil – the driver of the global economy – offers diversification opportunities and the potential for attractive returns, making it a compelling investment choice.

As nations and industries rely heavily on oil to fuel their economies, investing in Crude oil benchmarks, such as Brent and WTI, allows you to tap into the ever-increasing energy needs worldwide.

Crude oil has historically proven to be an effective hedge against inflation. When inflation rises, the value of oil typically increases, which could provide a safeguard during inflationary periods.

Investing in crude oil benchmarks, like Brent and WTI, allows an investor to capitalize on potential price fluctuations led by geopolitical shifts.

Crude oil benchmarks, like Brent and WTI, are influenced by different factors than traditional stocks and bonds. Hence, including them in your portfolio can help spread risk and reduce the correlation with other assets.

As emerging economies continue to industrialize, the demand for crude oil is expected to rise. The increasing reliance on oil makes investing in crude oil benchmarks an alluring opportunity.

Any disruptions in supply or unexpected spikes in demand in the oil market can lead to significant price movements. Investing in crude oil benchmarks provides exposure to these market dynamics.

Brent Crude and WTI (West Texas Intermediate) Crude Oil are the primary oil benchmarks. Brent Crude is widely regarded as the global benchmark, with around two-thirds of all crude contracts globally referencing its pricing, making it the most extensively used marker. On the other hand, WTI Crude Oil, known as light sweet crude, serves as the US benchmark for oil pricing. Due to their stability, most crude oil prices worldwide are linked to these benchmarks, reflecting their crucial role in the oil market.

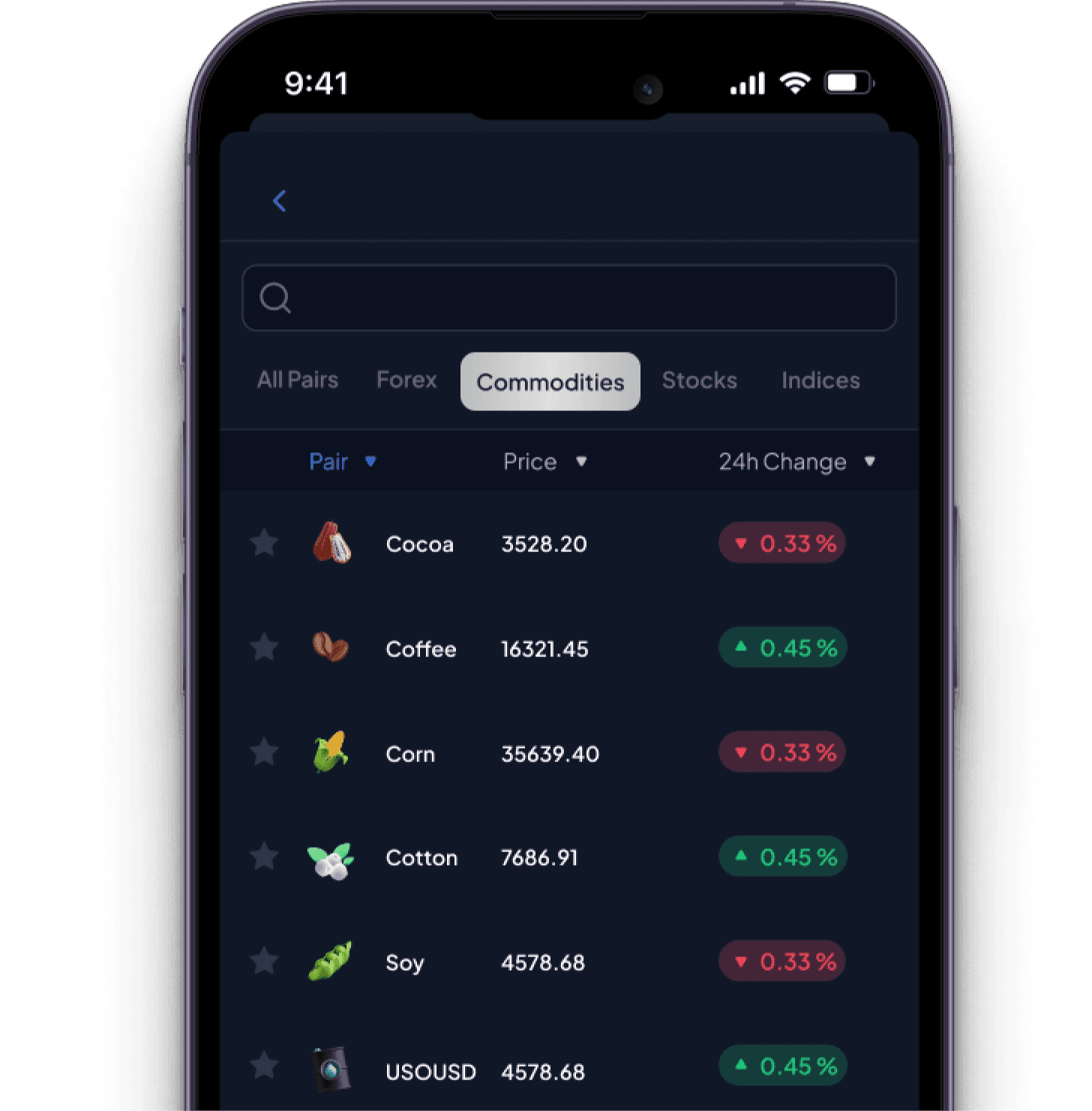

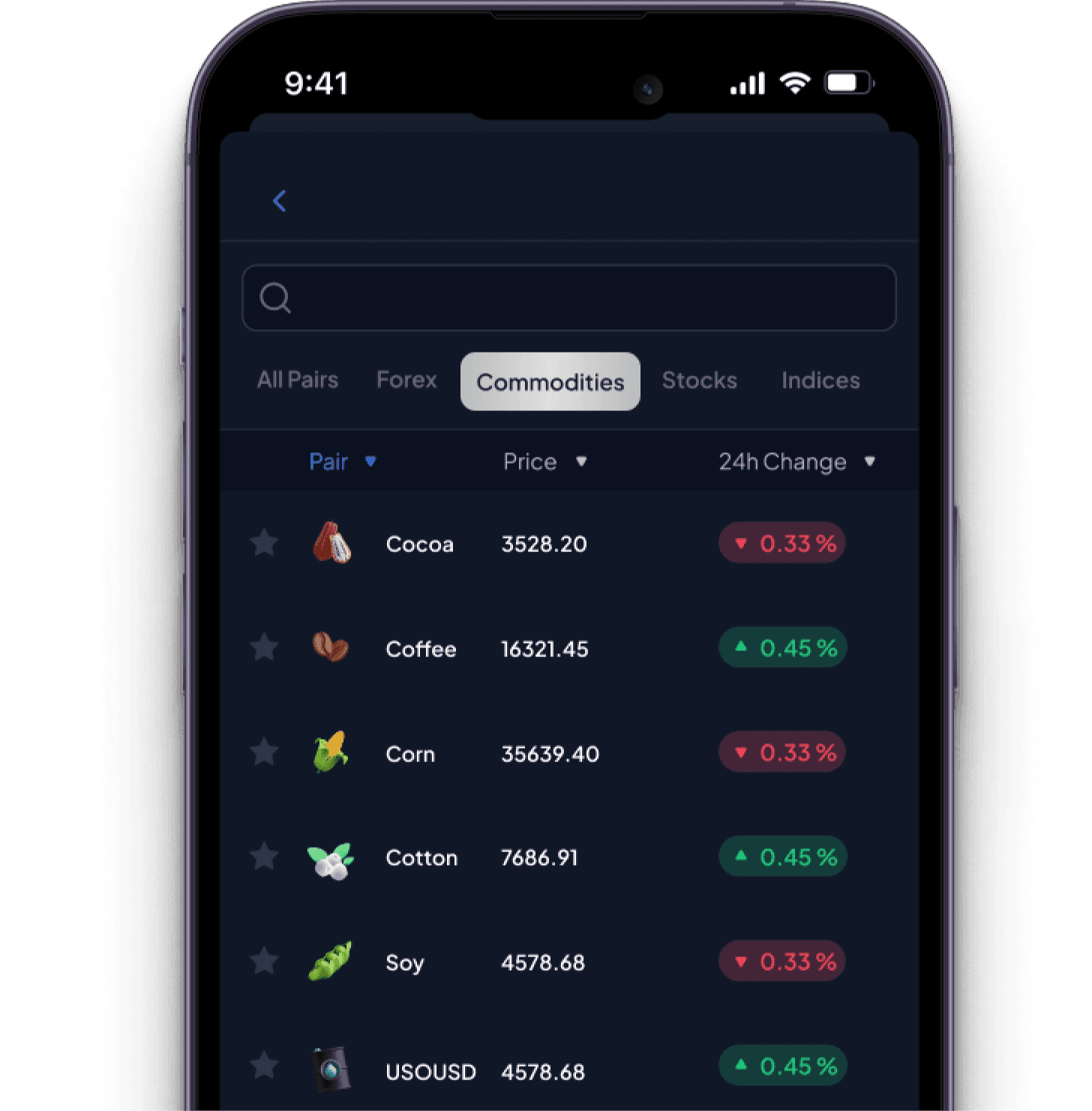

Invest seamlessly with advanced trading infrastructure and cutting-edge technology

Take advantage of the most favorable trading conditions in the market

Get more done in less time with intuitive trading tools

Highly regulated by 12 regulators worldwide

Hassle-free support around the clock and in multiple languages

A platform for flexible navigation and customization