Invest in Apple - Unlock Value and Growth

Apple stock has been in the news for all the right reasons.

Apple stock has been in the news for all the right reasons.

Apple's sticky customer base, strong financial position, international growth opportunities, expanding services portfolio, and continuous innovation in new products, make it a promising investment.

Apple's robust cash reserves provide financial stability, especially during periods of high-interest rates when borrowing is costly.

Apple's strong customer loyalty, especially among iPhone users, provides a consistent revenue stream.

Apple's expanding services, like Apple TV+ and Apple News+, diversify revenue sources beyond traditional hardware sales.

NVIDIA DRIVE solutions are witnessing rapid adoption across several new energy vehicles, with an automotive design win pipeline of $14 billion.

Expansion in India could add more than 170 million new users to Apple's ecosystem over the next decade, as estimated by Morgan Stanley, offering significant growth opportunities.

Continued innovation helps Apple introd uce new offerings, such as the Apple Vision Pro, which can open up new revenue streams and disrupt emerging markets.

Investors seeking exposure to the fast-growing technology sector, as well as those looking for value, can consider adding Berkshire Hathaway's largest holding — APPLE — to their portfolio. With market dominance of iPhones and innovative additions to its Services portfolio, Apple continues to demonstrate resilience. If you are looking to invest in both value and growth, Apple offers a compelling opportunity.

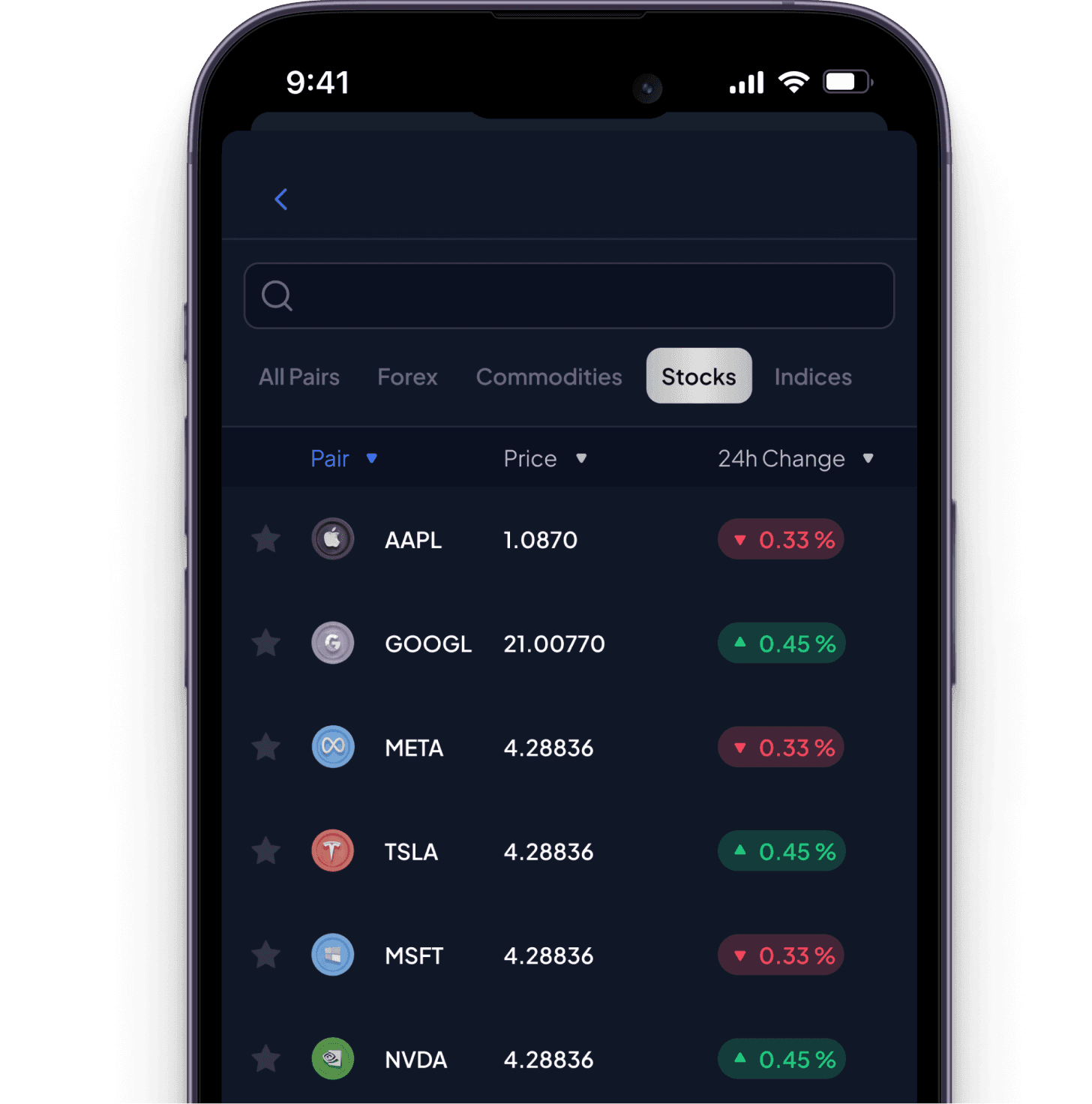

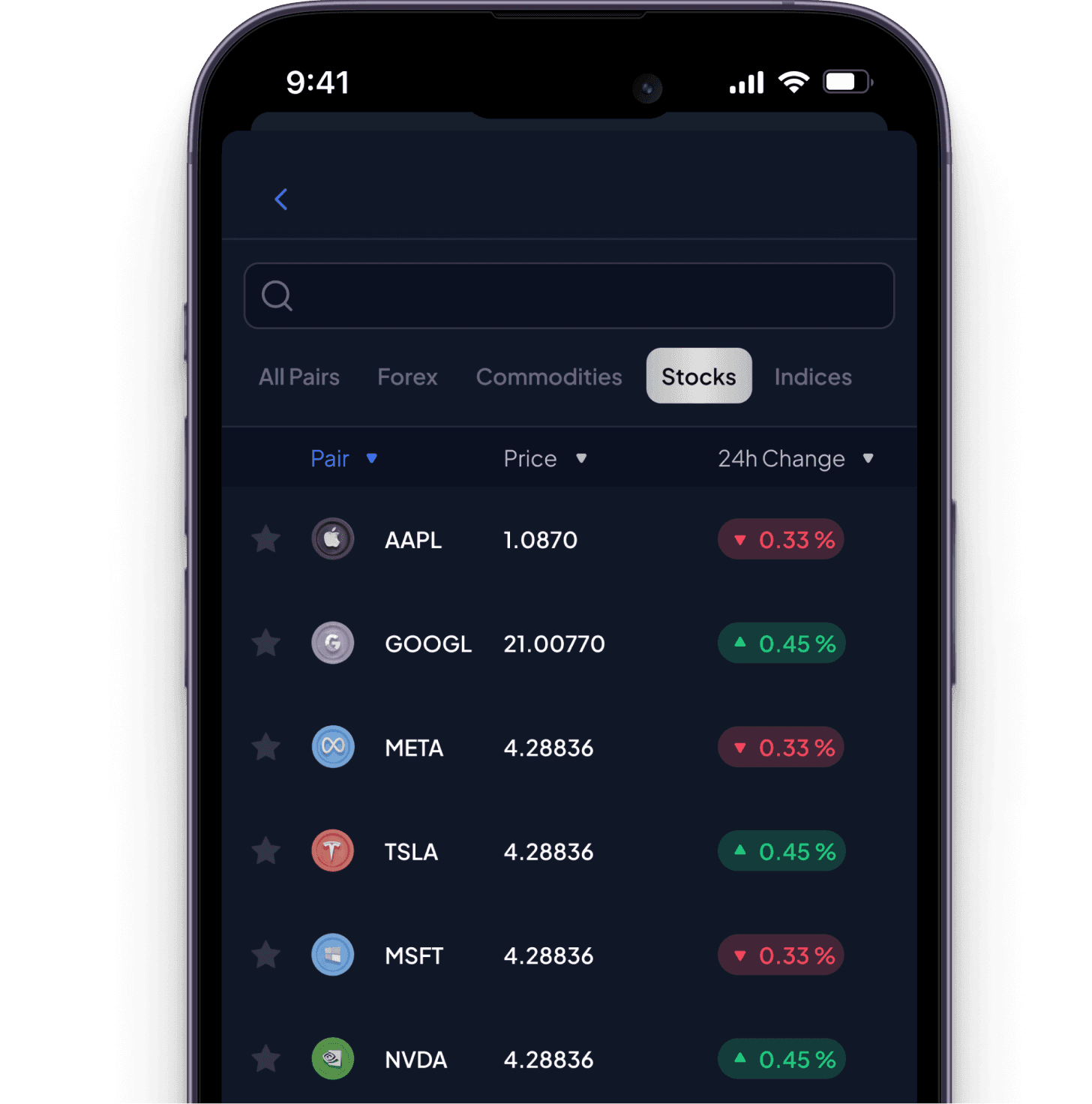

Invest seamlessly with advanced trading infrastructure and cutting-edge technology

Take advantage of the most favorable trading conditions in the market

Get more done in less time with intuitive trading tools

Highly regulated by 12 regulators worldwide

Hassle-free support around the clock and in multiple languages

A platform for flexible navigation and customization